Description

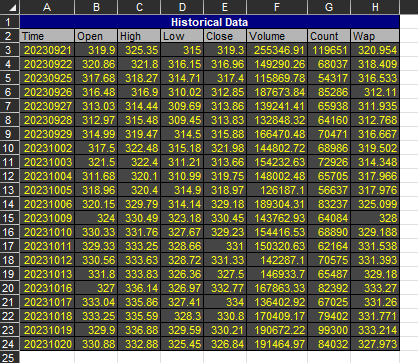

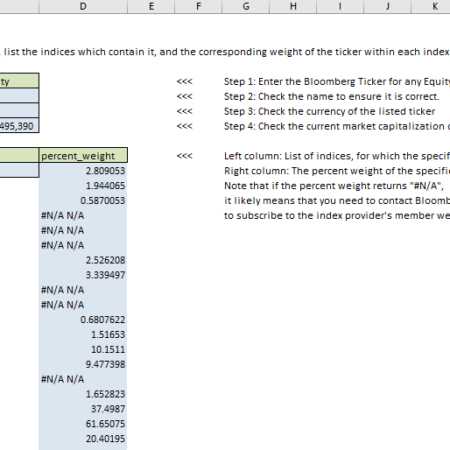

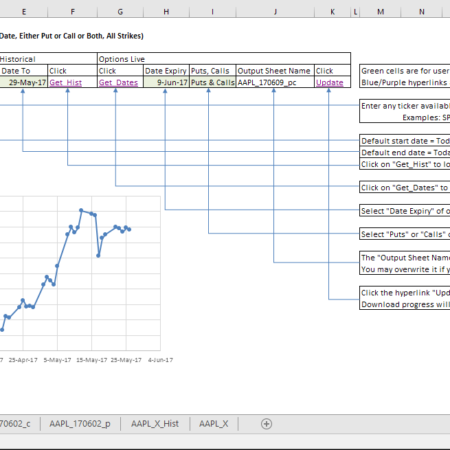

This Excel spreadsheet calculates the returns statistics of a set of user-defined tickers:

You may use any ticker available in Bloomberg that has historical data:

- Currencies (Curncy)

- Fixed Income (Govt, Corp, Mtge)

- Commodities (Comdty)

- Equities (Equity)

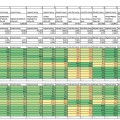

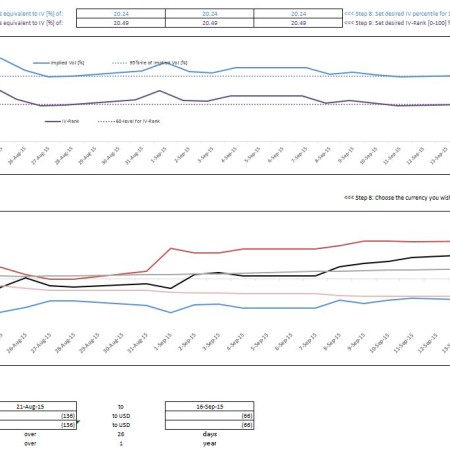

The returns statistics include:

mean, standard deviation, correlation, and beta (correlated standard deviation).

It includes an example of setting up a beta-neutral relative-value portfolio of 2 securities.

The data is pulled from Bloomberg, so you need to have run this on a PC with Bloomberg installed.

Please contact us

if you have requests to customize the spreadsheet.

Requirements:

- Microsoft Excel 2013

- Bloomberg API (for live data refresh)

Reviews

There are no reviews yet.